Manulife BANK Mortgage Simplification

SITUATION

50% of the loan applications had to be resubmitted.

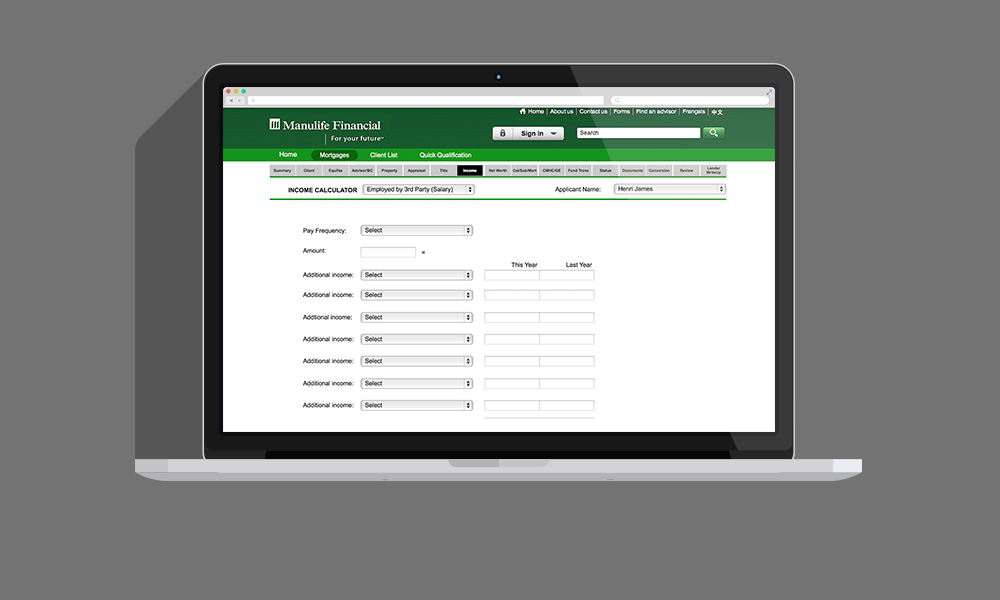

Why: sale representatives were omitting documents and explanations, using the wrong rule for income calculation, making entry or calculation errors. During negotiations, they were changing parameters that do not affect risk, such as reducing interest rates or the loan amount. This resulted in resubmission, delay and lower client satisfaction.

SOLUTION

The human factors study of the end to end process revealed the nature of human errors and necessary corrective actions.

It was recommended that guidance be provided as follows:

- in the short term with Excel and Checklist , and

- by improving guidance and support to the current mortgage system.

RESULT

We tested a prototype and found that 50% of all the resubmissions could be prevented.

Key causes of resubmission (income, documents, explanation, entries errors) have now been prevented, improving cycle time and client satisfaction.

“Cognitive does User Experience design for systems, processes, etc. We worked in the bank on the Mortgage End to End system suggesting ideas for how to solve issues with quality of data input, broken processes, and so forth. “What is great about Cognitive is that he brings a can do attitude to the work and is always coming up with ideas on how to improve the process/interface. They takes it a step further and develops prototypes so that the end users can actually see and feel what they will be doing and reacting to it.”

Arvind Sharma

Manulife Bank