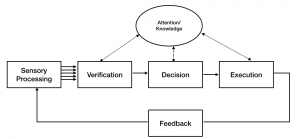

A doctor diagnosing, a mechanic repairing equipment, an army general deciding to send his force to combat all use the same model of human information processing. Gather information, evaluate and analyze information, make a decision, execute the action and obtain feedback. Humans have limited attention and judge information using the knowledge stored in their long-term memory.

In a loan application, the role of the loan adjudicator is to decide whether or not the loan application will be accepted. To achieve this objective, the adjudicator verifies and analyzes the information to ensure that the loan application meets the criteria and standards of the financial institution. These criteria are established over the years of banking practices.

Risk managers from across the organization review the loan portfolio history and update the risk criteria to predict the probabilities of default. These processes make better decisions and allow banks to comply with regulations.

The loan criteria for retail are well established, whereas in commercial credit, they take into account several financial ratios, the assessment of management capacity and the risk associated with the industrial and commercial sector.

The cognitive task analysis of the credit adjudicator for a mortgage shows that the key criteria are: loan-to-value ratio and the borrower’s repayment capacity. It boils down to assessing the real estate value and verifying the borrower’s income.

In the case of credit adjudicators, the information is provided by the loan officer via documents. Credit adjudicators first assess the information by conducting preliminary verifications. For example, an employee working for a well-established company providing a pay stub and a notice of assessment. When the amounts are comparable, he is confident about the reliability of these documents. A paystub belonging to an unknown company that seems to have a graphic alteration may not be considered reliable. The knowledge accumulated over years of experience will play an important role in the evaluation of information. For example, a pizza delivery man who claims to earn $ 200,000 will raise questions.

Since he has to process up to 20 transactions a day, he has about 15 minutes of his attention. As a result, he will not spend much time checking unreliable information and will reject the loan application or ask for more information.

Once the information is evaluated, the decision is quite simple. For a mortgage, it must be ensured that the loan-to-value ratio and the debt service coverage correspond to the bank’s criteria. .

The challenge is verification. For a mortgage, it represents 80% of the time spent and requires a thorough knowledge and judgment.

The challenge of automation is to provide an automatic learning algorithm that will outperform human performance in the verification task.